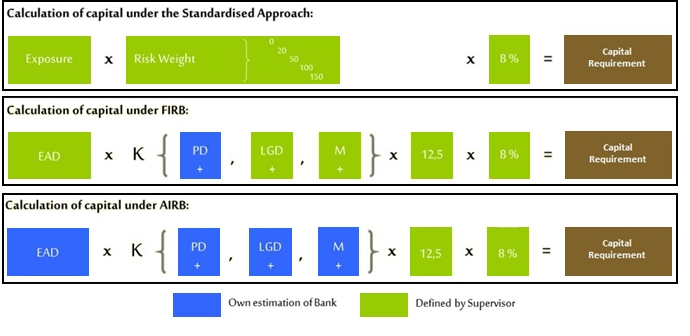

Data inputs of the foundation and advanced IRB approaches for credit risk | Download Scientific Diagram

Chapter 10 Revisiting Risk-Weighted Assets: Why Do RWAs Differ across Countries and What Can Be Done about It in: Stress Testing

An Introduction to Credit Risk in Banking: BASEL, IFRS9, Pricing, Statistics, Machine Learning — PART 1 | by Willem Pretorius | Medium