DR ORGANIC Organic Moroccan Argan Oil - Maschera Ristrutturante Capelli all'Olio di Argan Marocchino (Maschere) / Organic Moroccan Argan Oil - Restorative Treatment Conditioner (Maschere) : Amazon.it: Bellezza

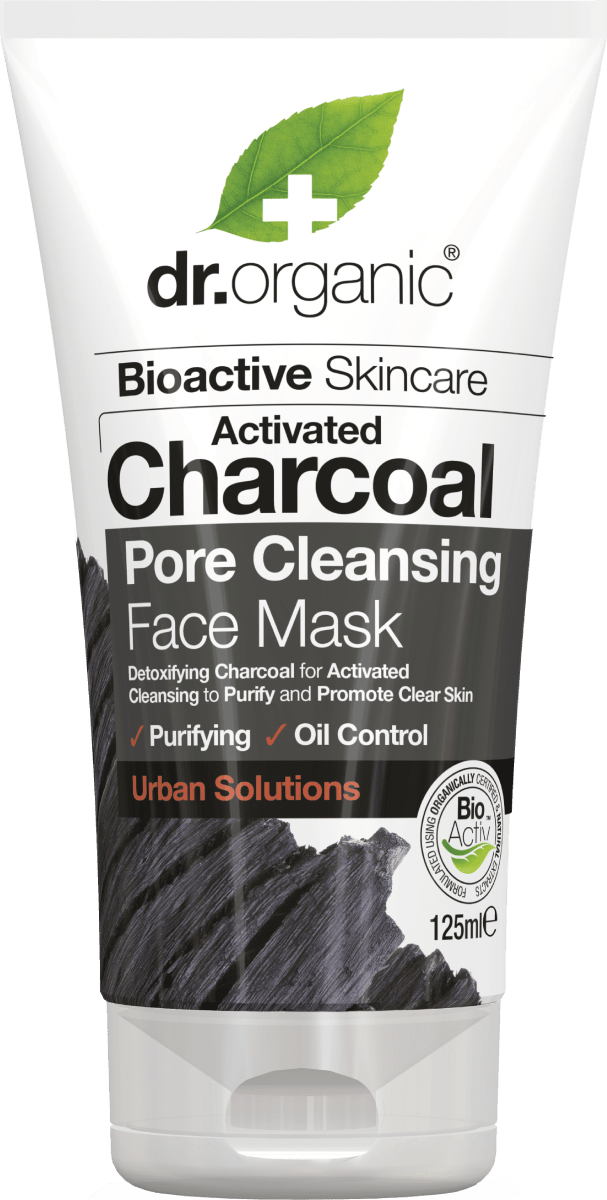

dr.organic Maschera viso purificante con carbone attivo, 125 ml Acquisti online sempre convenienti | dm Italia

Dr. Organic Bioactive Haircare Aloe Vera Shampoo - Shampoo per tutti i tipi di capelli "Aloe" | Makeup.it

Maschera al Carbone Vegetale Deep Pore Charcoal Mask Skin Clear Dr.Organic Tea Tree 100 ml | Starbene

DR ORGANIC Canapa - Intensive Conditioning Hair Mask | Maschera Capelli Riparatrice - Bio Boutique La Rosa Canina